Should You Sell or Rent Your Continuum Unit?

- loes

- May 11th, 2018

Selling vs Renting at Continuum

We have spoken to several Continuum owners who have decided they want to move to a single-family home. They have decided to make the move, but they are not sure yet on whether they want to list their Continuum unit for sale or for rent. There are a few aspects to keep in mind while making this decision. In this blog we discuss the questions one needs to ask in order to make the best decision on whether to rent or to sell a Continuum residence.

To Sell or to Rent a Property | Questions to ask

- Is the market going up or going down?

- In an upward market it is better to rent the unit until the market is about to reach its peak. This provides you with a nice asset appreciation, which adds to your cap return. One big question that owners have is ‘If I wait can I sell the home for more later on?” With this in mind we often ask questions to ourselves like: “What could hurt the market?”: Certainly raised interest rates, reduced benefits for homestead exemption or “What helps the market”? Such as tax incentives for high tax states like NYC, and California.

- In a correcting market, depending on how heavy the correction is, one should decide between holding on to the unit a bit longer or selling it right away before the market shifts from “Oversupply” to “Recession”

- What is the condition of my home?

- If your property is really nicely done, the premium you get when selling can disappear if tenants don’t like looking after it, and it devalues the product.

- Is it the ideal ‘rental property’?

- Some homes lend themselves to great returns while others are limited. Tenants don’t value property in the same way that end-users do. For example, end-users will value condo elevations, finishes, views, HOA fees and financial stability of a condo much more than renters do.

- Are there better properties to buy to get the same return or better, and put more money in your pocket?

- Here is an example: If you own a home of $2,5M, you should get a $15K monthly return on your rental (The ideal is $6k return per $1M invested). If you won’t get that (lets say you get $11K) is it not better if you could own two townhomes for $1M a piece and get $6k per month from each one plus $500k in your pocket or a third property that could yield you $3,000 per month. The other element that is worth to be aware of is that owning the investment property is also about asset appreciation. In the lower price markets we cannot un-typically experience a 10% increase in home value over a year, while the upper market experiences a totally static market. Typically, bigger homes appreciate slower than entry level homes ($1m). Let me give you an example to explain. If you rent a big home for 3 years and get $12,000 per month but the value changes marginally from $2.5m to $2.7m over 3 years you only make $200,000 on appreciation when you sell. If you were to buy 2 x $1,250,000 homes they could quite easily appreciate from $1,250,000 to $1,600,000 over 3 years, which provides a profit of $700,000. Obviously you are $500,000 better off with the latter option.

- How do you feel about being a landlord?

- How do you feel about a late night call “The air-co is broken” or “The washing machine is leaking”. Condos are less labour intensive than homes, but tenants are still inclined to call you with their inconveniences.

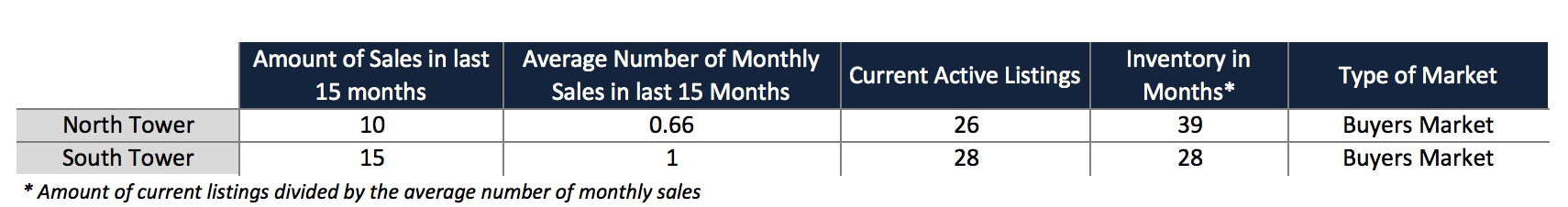

Months of Inventory at Continuum

Current Inventory

Historic Inventory

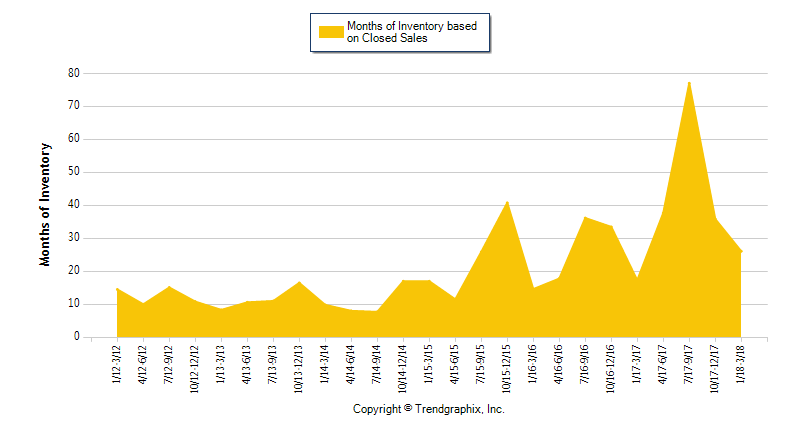

Average Prices per SF over the Years at Continuum

In 2018, till March 23rd, only 5 units were sold. 3 Units sold in the South Tower for an average of $2,035 per SF and 2 units sold at the North Tower of which one was a cabana. The condo unit that sold traded for $1,732 per SF

Selling vs Renting your Continuum Condo Unit

The months of inventory at Continuum are following the same trend as the overall South of Fifth market. The SoFi market sees inventories between 17 and 56 months while Continuum is looking at 40/45 months of inventory in both towers. The most luxurious units see a higher inventory than the lower-end of the market. Like in most markets, entry levels are seeing more demand than the most exclusive units. This also means that there is a bigger chance you will sell your more affordable unit faster. As mentioned before we recommend a $6K return for every $1M invested. This is not always easy to get, but it is an ideal and reachable value. Overall we are bullish on the Continuum condo market. This unique condo in the exclusive South of Fifth area has seen inflated prices for the last few years with many buyers paying above-market prices. Nowadays with a limited number of buyers, who at the same time are more price conscious we see that the supply and demand curve has shifted. As this unique most-southern point of Miami Beach offers limited oceanfront lots we are sure the market will be stable again after the necessary corrections.

Under current market conditions, we are looking at an inventory of 3 to 4 years. Please note that for quantitate reasons we did not divide this Continuum study into price ranges, but generally speaking the more affordable units will have less months of inventory than the most exclusive units (please see inventory levels of SoFi market, which are divided into price ranges).

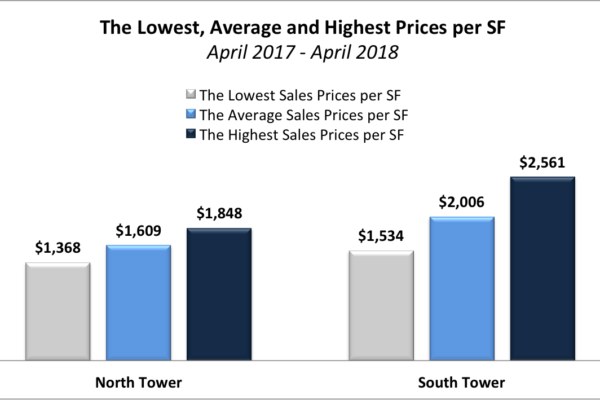

If you bought your condo at market value around 2013 or before, when the market was still far from its highest point, you can either sell or rent it now. If you bought at the height of the market at the inflated prices it will take some years before you recuperate that money. As demand has softened and supply is high it will be hard to sell it now for the money you have bought it for. If you can wait a few years, you might want to rent the unit until the market has reached a higher sales point per SF. If you want to sell within 2 years, we suggest you sell it now before the market adjusts even more. As the inventory is high there is space for additional adjustments. If you do decide to sell, please keep in mind that this is not the 2014 market anymore. Buyers are more price conscious and in general more hesitant to “pull the trigger”. In the last table below we show you the average, lowest and highest sales prices per SF.

In case you are looking for rental income, please remember that the higher-end properties are less easy to rent and high-end properties tend to appreciate at a slower pace than lower-end properties. For example if you own a $5M dollar Continuum unit and you rent it to gain income this will generate around $20,000 per month at Continuum. Lets say you would invest that money in Coconut Grove townhomes. You could either buy 5 townhomes for $1M, each generating between $5K and $6K of rental income per month. This would provide for an income of $25M to $30M, which is much more than you could make at Continuum while these properties are appreciating at a much faster pace given the scarceness of townhomes.

We recognize that each unit is unique and therefore it is difficult to provide everyone with a suitable answer. Please contact David Siddons today at +1.305.508.0899. Depending on your personal interests and goals we will create the most financially sound strategy

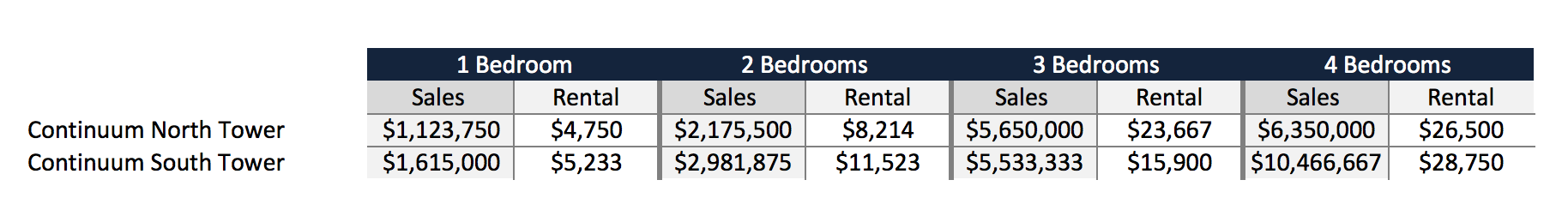

The Average Rental vs Sales Values at Continuum

The Lowest, Average and Highest Sales Prices per SF

The lowest and highest sales prices per SF are taken as an average of the three lowest and three highest sales price per SF.